- Fido Community

- Forums

- Phones and Devices

- Understanding taxes on discounted phones

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Flag this to a Moderator

January 2021

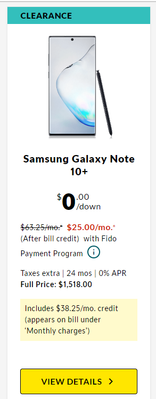

Considering customer have a plan with fido $50/month with x amount of data every month and adds phone from fido.ca as displayed below:

Customer is supposed to pay $25/month for Samsung Note 10+

- Full Price: $1,518.00 which is $63.25/mo with $38.25/mo. credit

- Per month $25.00/mo

So my question is simple, will there be taxes as

- Plan + Phone monthly cost = $50 + $25 + Province applicable taxes; For Quebec(15%) ~$86.25/month

OR

- Tax on total price of the phone $1,518.00 as

- Monthly Plan + Phone installment (without credit) + Province applicable taxes;

- $50 + $63.25 + Taxes - Bill Credit; For Quebec(15%) ~$91.98/month

Thanks.

Solved! Go to Solution.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Flag this to a Moderator

January 2021

Intersting, I didn't read this post before I posted my question, almost identical.. I made some assumptions.. let me know what you think...

So yes, the Promo Discount is deducated from the amount before taxes, however, the taxes are still calculated on the full amount before promo deduction.

This is not a standard retail to consumer practice, however, it has always been the standard business to business practice. In particular you see it with software sales to business customers sold at discount.

This helps Fido to inflate the the perception of a very significant discount you get, where in fact the discount after taking into considerstion taxes is much less. I guess many people don't pay attention to read the small print and wouldn't go back and return the open box device once they find out on their first monthly statement they receive well after they got accustomed to using the new phone and well after the return period is over.

So just be aware, if Fido puts the SRP $700 for a device sold for $150 (e.g. an older Iphone), you are paying way more money in taxes payments to Fido.

Clever accounting trick, possibly also helps their balance sheet look better since they are not writing off the unsold inventory, but instead hiding the discount as an expense into your contract.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Flag this to a Moderator

January 2021

Hello @hsharpreet,

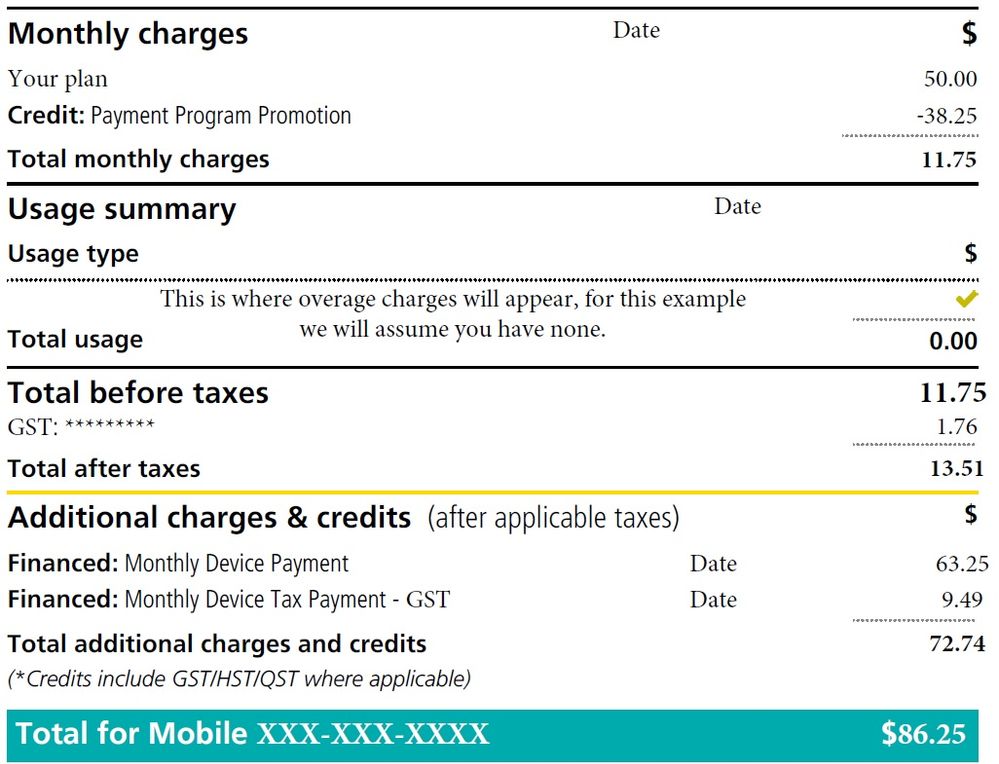

Great question! This can be very confusing how Fido chooses to do the billing when financing a device with a discount.

A few things to note Fido only applies the promotion once per billing cycle so if you do the change during your billing cycle you will only get the promotion applied once.

The cost of the device will never change you will be billed in your case the full $63.25+tax for the device and the $38.25 will be applied as a monthly credit.

After your first invoice going forward, the charges should appear as follows.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Flag this to a Moderator

February 2023

This is a great reply that clearly shows the extra tax you pay on device is removed from the plan so the end result is the same as if you paid the reduced taxes on device and full taxes on plan... it's just moved around to confuse us haha

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Flag this to a Moderator

February 2023

Of course, we won't be charging you the taxes twice

Though it's important to note that the discount (bill credit with your phone's financement) is not applied directly to your phone's cost. There's a reason why we apply the credit separately, to your monthly fees under the "Monthly Charges" section.

What you need to know is that your phone's cost remains the same, should you choose to continue your 2 year term or choose to opt out earlier. However, your bill credit promotion is only ongoing as long as you're on a contract. Meaning that if we take the example above:

- Phone's cost is $63.25+tx monthly

- Bill credit is $38.25+tx monthly

- Overall you'll be paying $25 monthly for the duration of your contract

But if you choose to opt out of your term with 6 months remaining, you will be billed the remaining cost of the phone. Since the bill credit is no longer in effect, the cost would be $63.25 * 6 = $379.50+tx

Hope this clarifies why the discount is applied separately!